WANT TO SIMPLIFY YOUR PAYROLL AND MINIMISE FINANCIAL RISK?

Payroll Optimisation

Payroll can be complex and time-consuming. That’s why we’re dedicated to helping New Zealand businesses like yours navigate the intricacies of payroll compliance. Our comprehensive solutions streamline your payroll processes, minimising financial risk and freeing up your time to focus on what matters most.

Our HARE team brings years of experience working with New Zealand businesses.

We understand the complexities of payroll, from tackling intricate remediation projects to ensuring ongoing compliance and providing valuable insights into your processes.

Proactively managing your payroll can identify and prevent employee overpayments, saving your organisation an average of over $1 for every $100 in payroll costs. By implementing robust payroll controls and auditing processes, we can help you to ensure accurate compensation and mitigate financial risk.

Maintaining vigilant oversight of your payroll systems, even when accurate processes are in place. Proactive monitoring can identify and quickly highlight any potential human errors or anomalies that may cause future non-compliance.

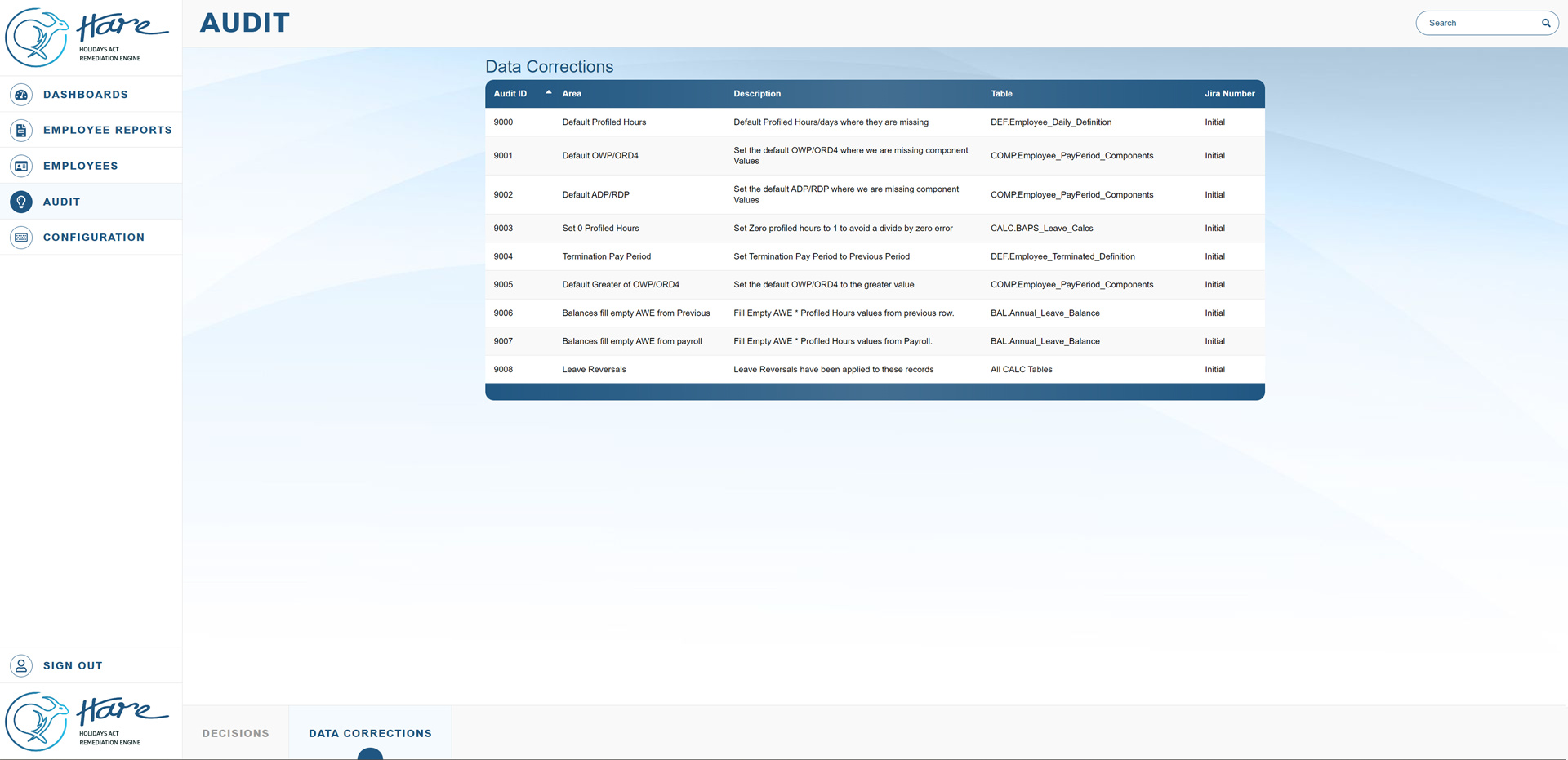

In a constantly changing regulatory landscape, it is impossible to predict what requirements may arise in the future concerning staff compensation. We can help you maintain a comprehensive, auditable record of past business decisions and the rationale behind them to provide a critical source of truth, demonstrating compliance and defending the integrity of your processes.

When evaluating a potential acquisition, analysing your target’s past and projected payrolls under and overpayments, provides critical financial insights. We can help you uncover hidden risks and opportunities.

Ensuring payroll accuracy is not only a fundamental corporate responsibility, but also fosters high levels of trust and workforce morale. With a centralised monitoring platform, we can help you proactively identify and resolve any discrepancies, and maintain a reputation as a good corporate citizen.

Continuous monitoring for payroll anomalies and errors to safeguard your organisation’s financial health and integrity. Implementing a platform that provides visibility allows you to quickly identify and address any suspicious activity or data discrepancies before they escalate into larger issues.

As companies grow through acquisition, they often inherit a patchwork of payroll systems that can create visibility gaps and potential problems. By implementing a single, unified monitoring layer, we can help you to quickly identify and address any discrepancies across your expanded payroll operations, mitigating risks before they become larger issues.

Mero offers innovative payroll solutions to ensure compliance, support your HR team, and provide peace of mind with accurate employee payments:

HARE – Holidays Act Remediation Engine

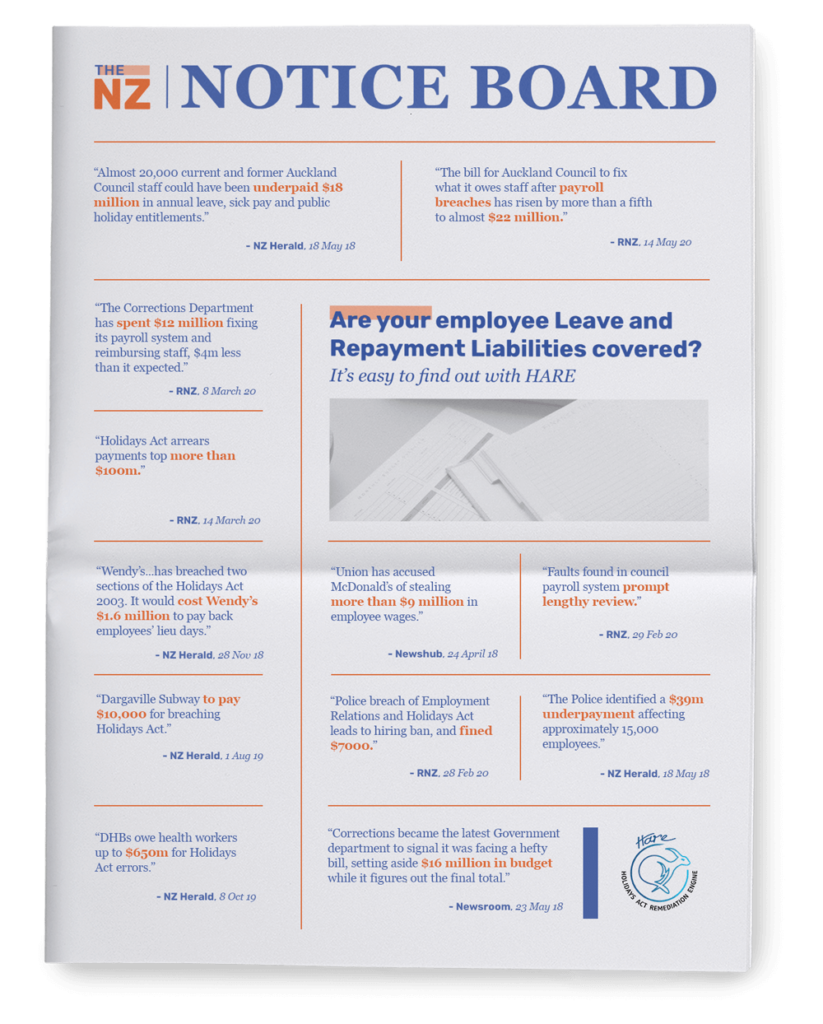

Navigating New Zealand’s complex Holidays Act legislation can be a real headache for businesses.

Many companies aren’t fully compliant, leaving them vulnerable to potential liabilities. That’s where Mero’s cloud-based Holidays Act Remediation Engine comes in. Our powerful engine can accurately recalculate historical leave and payment entitlements, even for large organisations with thousands of employees. We handle the complex computations, ingesting data from multiple payroll sources to provide a clear picture of your liabilities.

Recalculations and Remediation: Understanding the Root Causes

Businesses often face the need for recalculations and remediation, driven by three key factors:

When your systems are not calculating accurately, leading to incorrect results and potentially impacting your business decisions.

New regulations may emerge before your systems are updated to comply, requiring recalculations and remediation to ensure adherence.

Incorrect data input, such as typos or missing information, can lead to inaccurate calculations and necessitate remediation.

By understanding these root causes, businesses can proactively address potential issues and minimise the impact of recalculations and remediation on their operations.

Regulatory Compliance

“Employers are obliged to remediate employees for current and historic underpayments”

MBIE continues to produce guidance on the Holidays Act 2003, because in their own words “it has become apparent that non-compliance is a significant issue.” It was also recently reported that out of all the organisations the Labour Inspectorate had looked into over the last few years, all had degrees of non-compliance, with many major breaches.

There are also many more holiday pay articles hitting the press with regularity – all diverse employers with a failure to have correctly complied with their leave entitlement obligations.

We encourage you to proactively manage your compliance journey by taking a considered approach. Rather than waiting for an Enforceable Undertaking to dictate your timeline, use the time and resources you have now to prepare for a potential audit.

Our Solution

At Mero, we understand the challenges of working with complex HR data. We have extensive experience in transforming diverse data sources, cleaning and structuring them to unlock valuable insights and drive business outcomes.

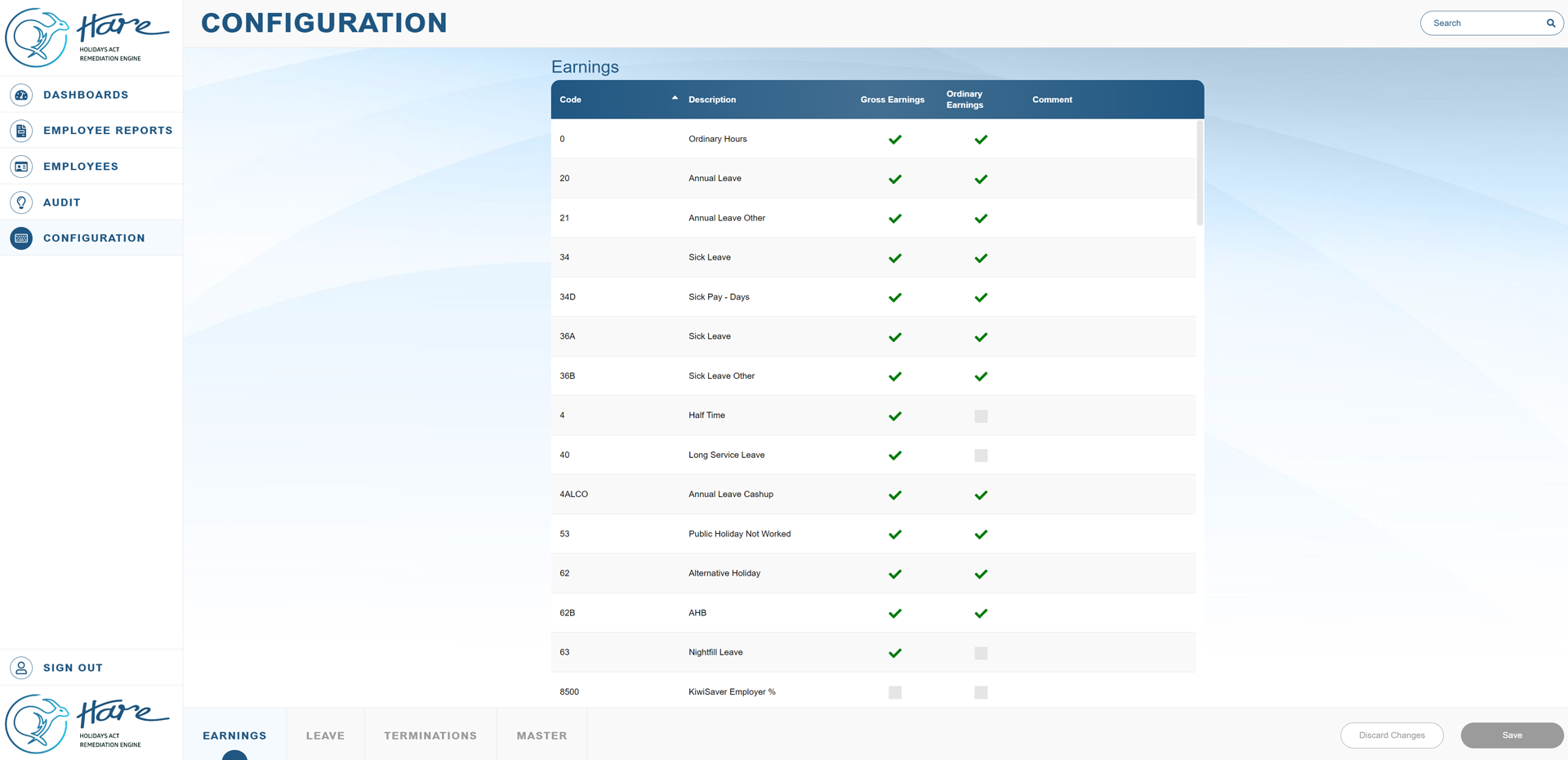

Our innovative HARE rules-based engine simplifies this process, providing a faster and more efficient way to recalculate holiday payments. This powerful tool allows you to iterate through multiple scenarios, ensuring accurate and reliable results.

We have worked with over 50 clients and imported data from a wide range of payroll systems and extracts. This deep understanding of HR data challenges, coupled with our HARE solution, positions us well to help you streamline your holiday payment calculations.

As at August 2024

The Holidays Act Remediation Engine Is:

Pre-Built

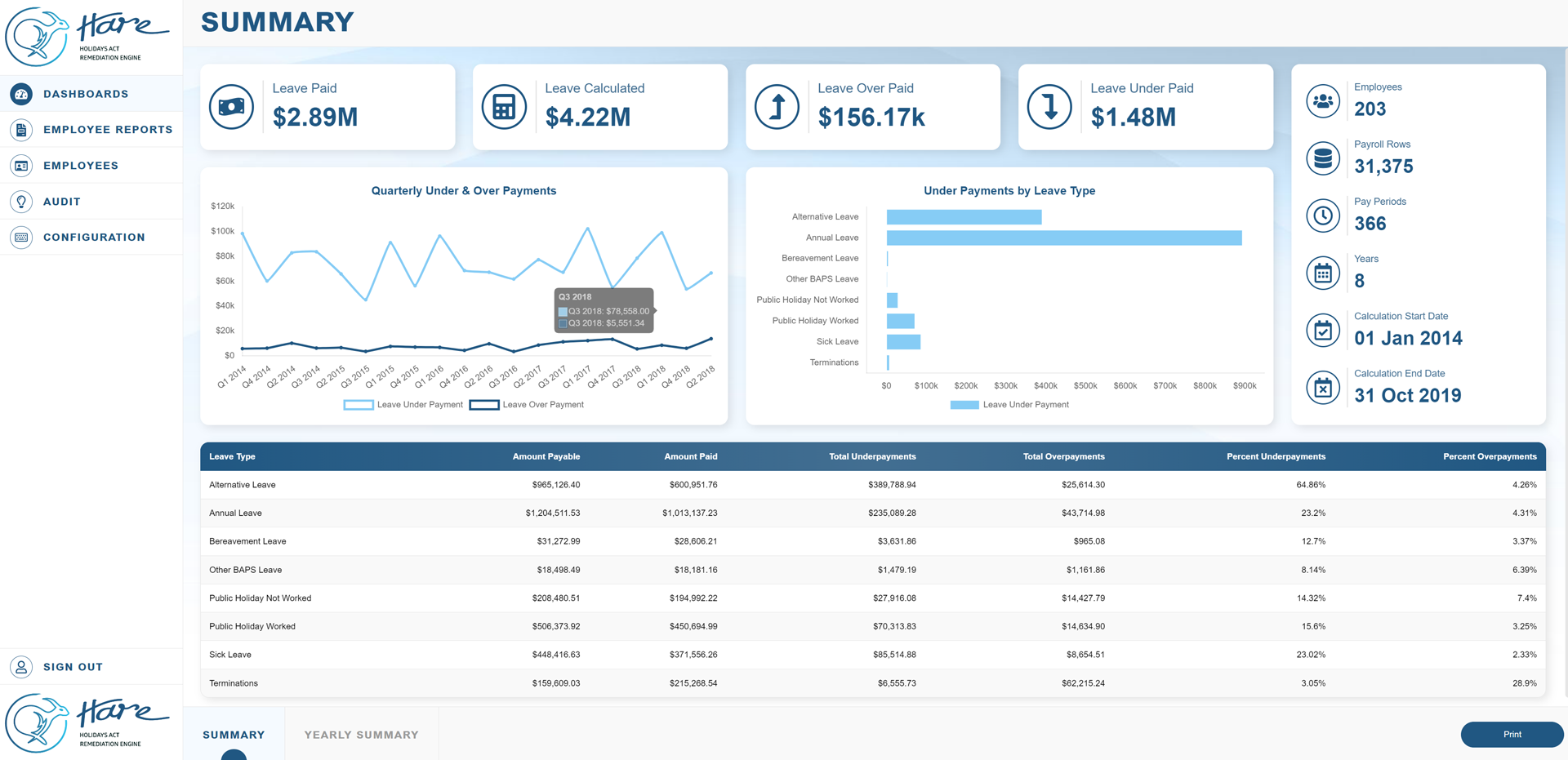

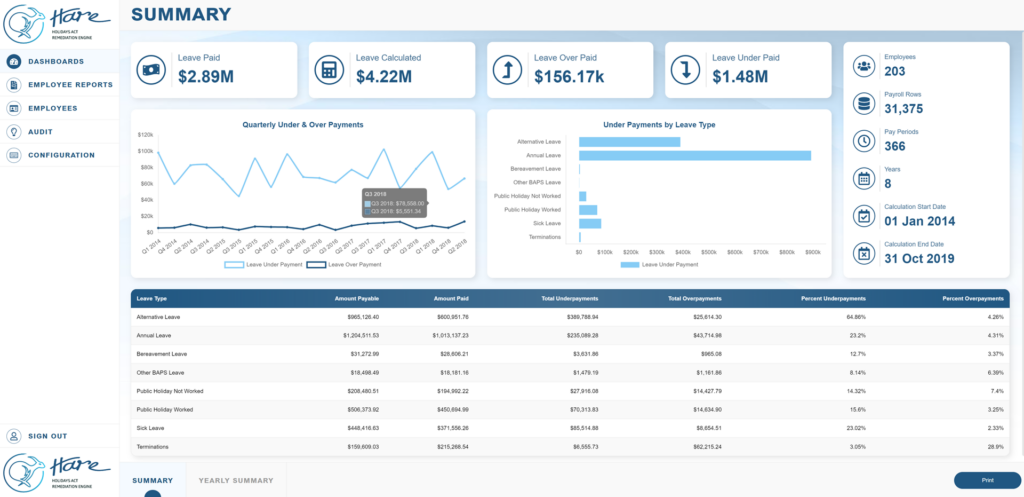

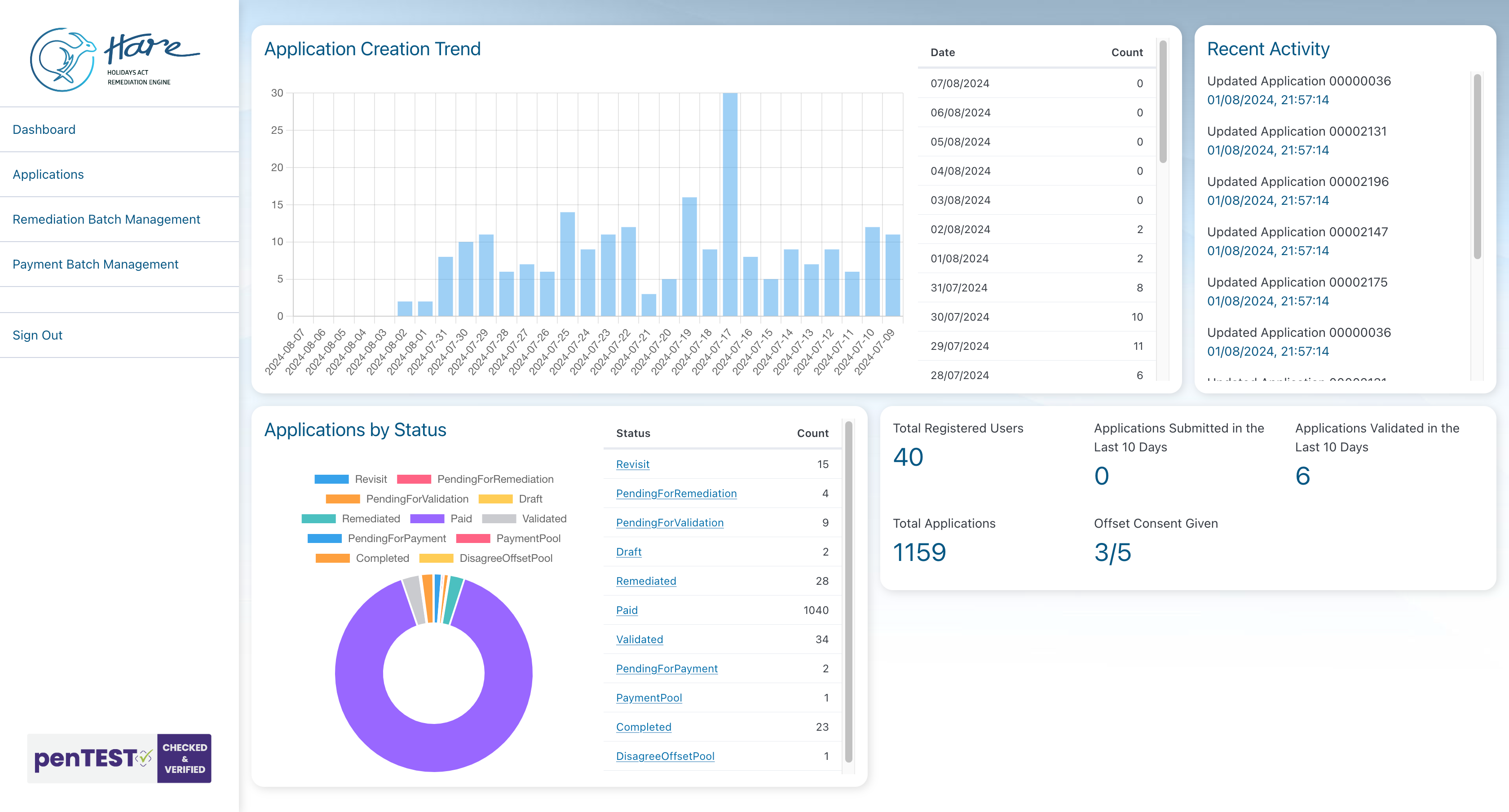

Our cloud-based, pre-built calculation engine includes predictive profiling, data validation, dashboards and detailed reports. We can ingest payroll, leave and timesheet data from virtually any source.

Smart

HARE can substantially speed up and accurately calculate what your leave payments should have been, provide comparisons to actuals and lets you drill-down to under and overpayments for every block of leave.

Configurable

Modify parameters and assumptions, re-classify and re-run in minutes – all with a complete audit trail. Remediating multiple scenarios and patterns can also save you significant amounts of time and money, as you decrease variances and increase precision of results.

Guiding You Through Discovery and Remediation

Discover

Our approach to compliance starts with a brief initial assessment to baseline your current compliance landscape, identify potential risks, and explore areas for optimisation. This process can be invaluable for due diligence during acquisitions or simply for gaining a clear picture of your current situation.

Remediate

A full remediation process is a collaborative journey with your team. We work together to ensure all calculations are accurate, compliant, and tailored to your specific business needs. Our comprehensive approach covers everything from payroll extraction to employee payment details, providing you with a complete solution. The flexibility of our model allows you to explore different scenarios, minimising your liabilities while ensuring you meet all legal obligations.

“The team made the complex simple and relevant, and the scenario analysis in the final report was very helpful. The quick turnaround time for the findings and analysis was also appreciated.”

Corporate Development Manager

at a leading AU/NZ Infrastructure Services Provider

Are your employee leave and repayment liabilities covered? We’re here to help.

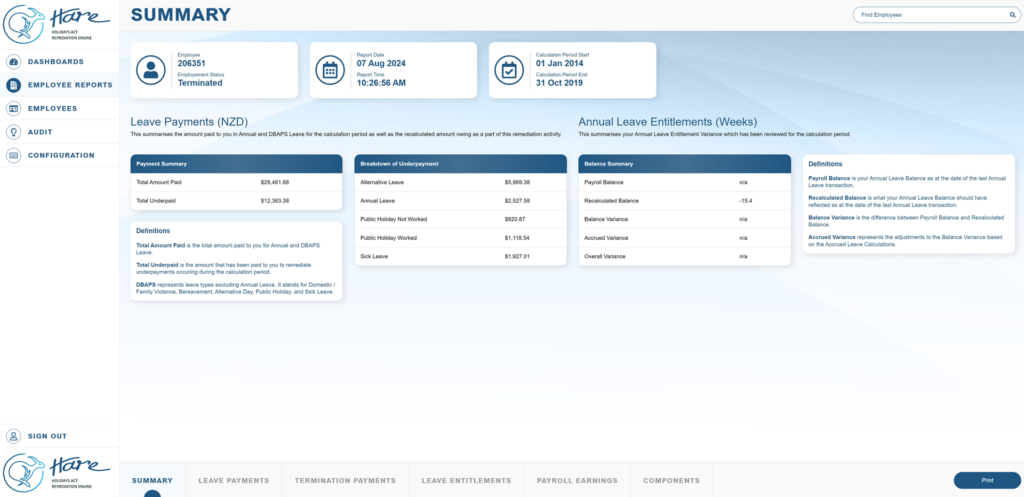

Effortlessly Address Employee Queries with the HARE Reporting Console

The HARE Reporting Console simplifies the process of understanding your remediated payroll data. With its user-friendly dashboards, views, and reports, it significantly reduces the time spent answering employee questions after a payroll compliance review.

Designed with transparency in mind, the HARE Reporting Console provides access to detailed recalculation data. You can explore high-level summaries or delve into the specifics of each leave transaction. Securely share the console with your remediation and payroll teams, empowering them to independently analyse and report on your leave compliance data. The console also allows for easy printing and downloading of information, making it simple to address employee inquiries after the remediation process.

Simplify your payroll compliance reporting and empower your team to address employee queries with ease

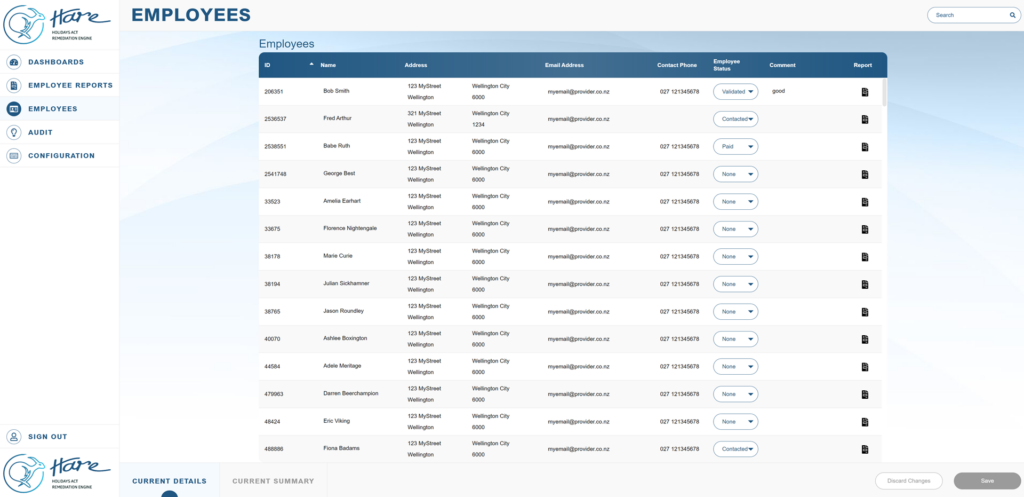

Simplify Employee Claims with HARE’s Employee Claims Portal

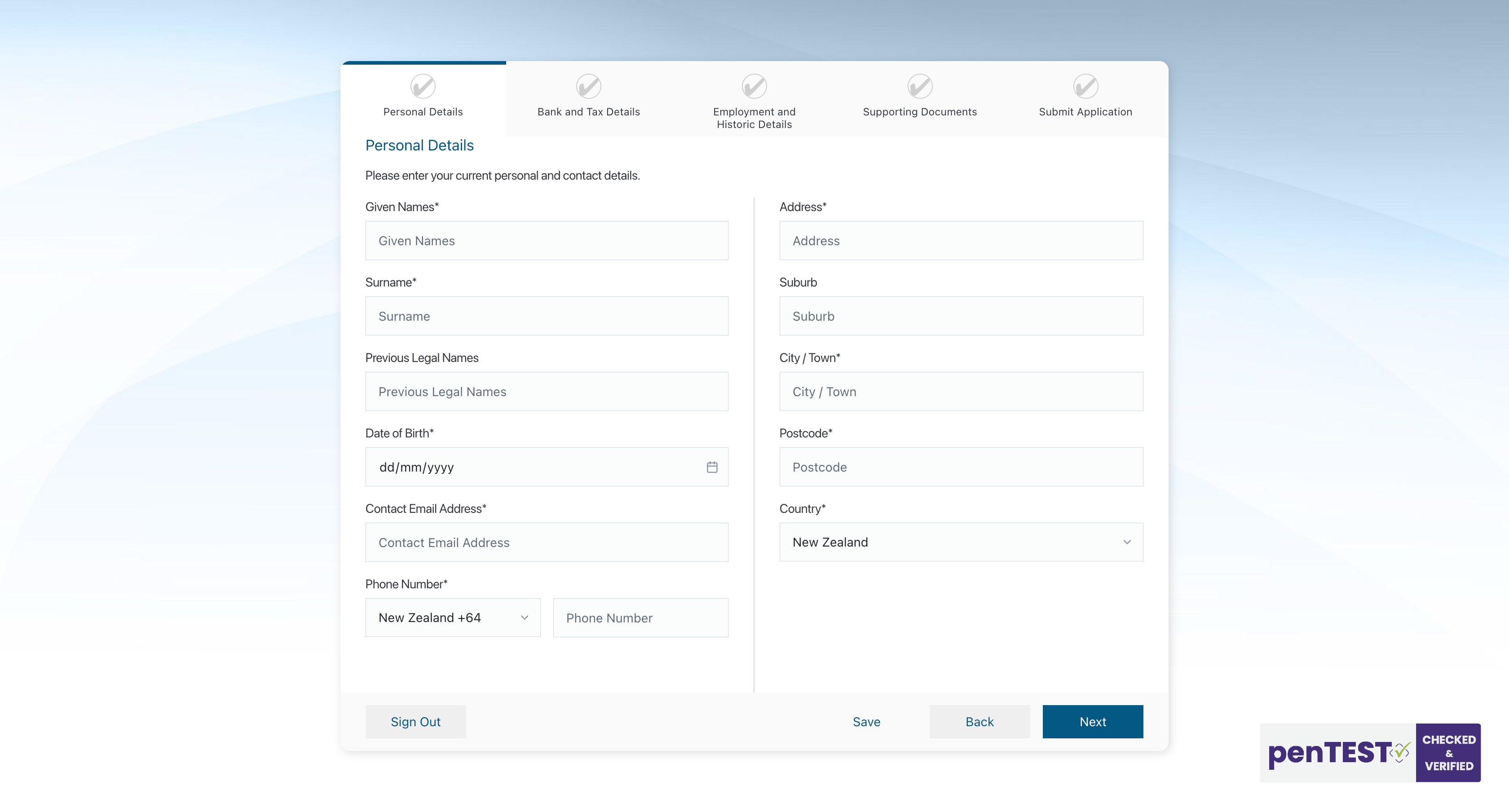

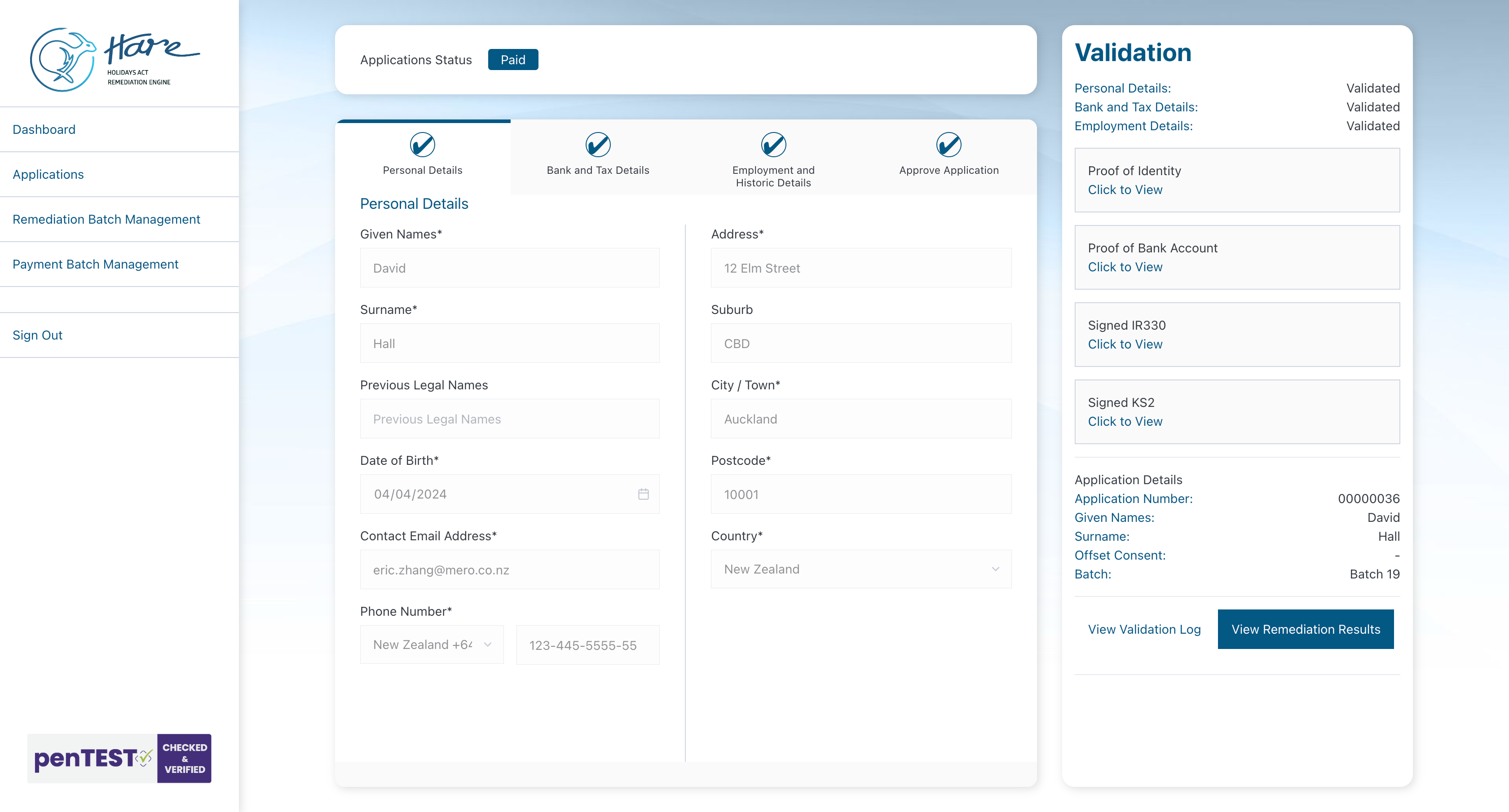

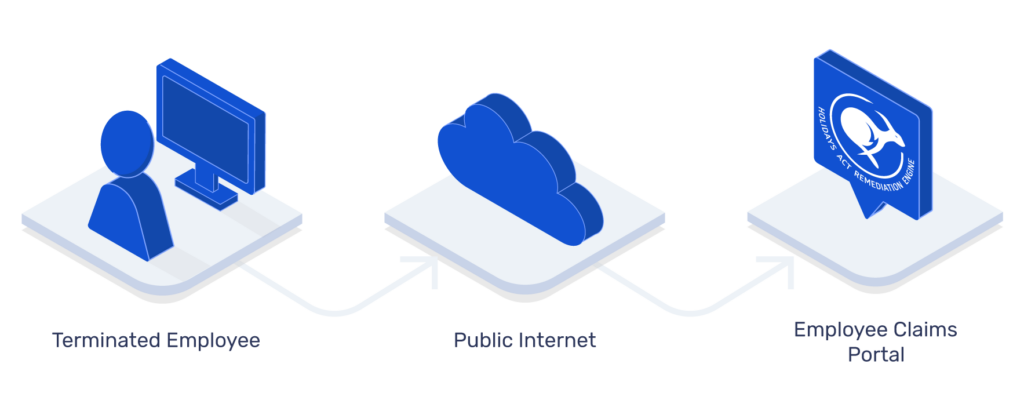

Ensuring compliance with the Holidays Act is crucial for all employers. While current employees can be more easily addressed, reaching out to past employees for historical underpayments presents a unique challenge. Verifying identities, gathering correct payment information, and managing the claims process is time-consuming.

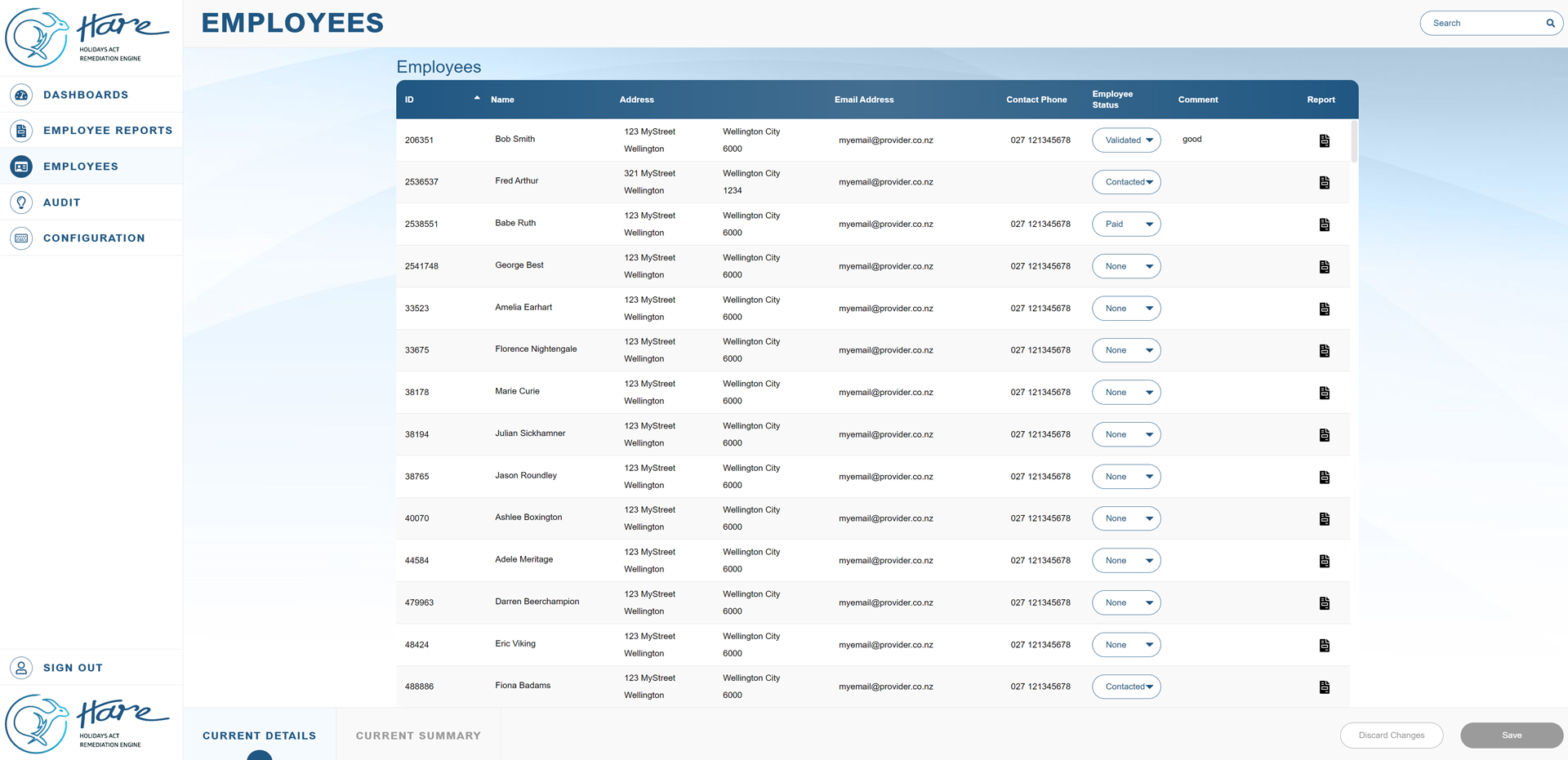

HARE’s Employee Claims Portal streamlines this process by providing a secure online platform for current and past employees to register their claims. They can easily provide the necessary information and documents to confirm their identity and payment details.

Once registered, the portal guides your team through a clear workflow, allowing you to validate, authorise, and approve payments efficiently. Employees are kept informed every step of the way, ensuring a smooth and transparent experience.

The Employee Claims Portal Helps You

Employees are guided through a simple, step-by-step application process to ensure accurate information.

Efficiently process validated applications for access to accurate leave recalculations.

The system automatically assesses submitted data against your existing records, streamlining validation.

Only employees that become registered users and your designated internal data processors, can access the core leave calculations of the private claims portal.

Data processors can individually review and approve applications, with options for mass validation and correction of errors.

Track payments and update application records with ease.

Employees receive regular updates on the status of their applications.

HARE’s Employee Claims Portal is the key to efficient and compliant claim management.

Contact us today to learn more about how we can help you streamline your processes and ensure a smooth experience for your employees, and your payroll team.

Get Started With A Business Discovery Session

Great conversations lead to great outcomes. Get in touch below, and we’ll contact you to arrange a 15 minute business discovery session.