If you’re in HR or manage your company’s payroll, you know the immense complexity of compliance. Whether it’s navigating the Holidays Act or simply keeping up with standard legislation, it’s a constant challenge. But here’s something crucial many organisations overlook: payroll compliance risks extend far beyond a single Act. External auditors are increasingly uncovering other, non-Holidays Act related, non-compliance issues. And when they do, it leaves businesses scrambling, often unsure where to even begin.

The “Needle in a Haystack” Problem is Real

We recently worked with a client whose Payroll Manager faced a moment of dread when a quiet audit query landed on their desk. It hinted at a small discrepancy in historical payments for just a few dozen workers. The daunting task was clear: sifting through thousands of pay entries for hundreds of employees, sprawling across multiple years. The data was there – buried in core payroll systems, archived roster schedules, separate timesheet software – but joining it all together to prove exactly who was owed what, and how to make it auditable? It wasn’t just like looking for a needle in a haystack; it was a vast, unmanageable field of them, each one a potential unquantified liability. They needed help.

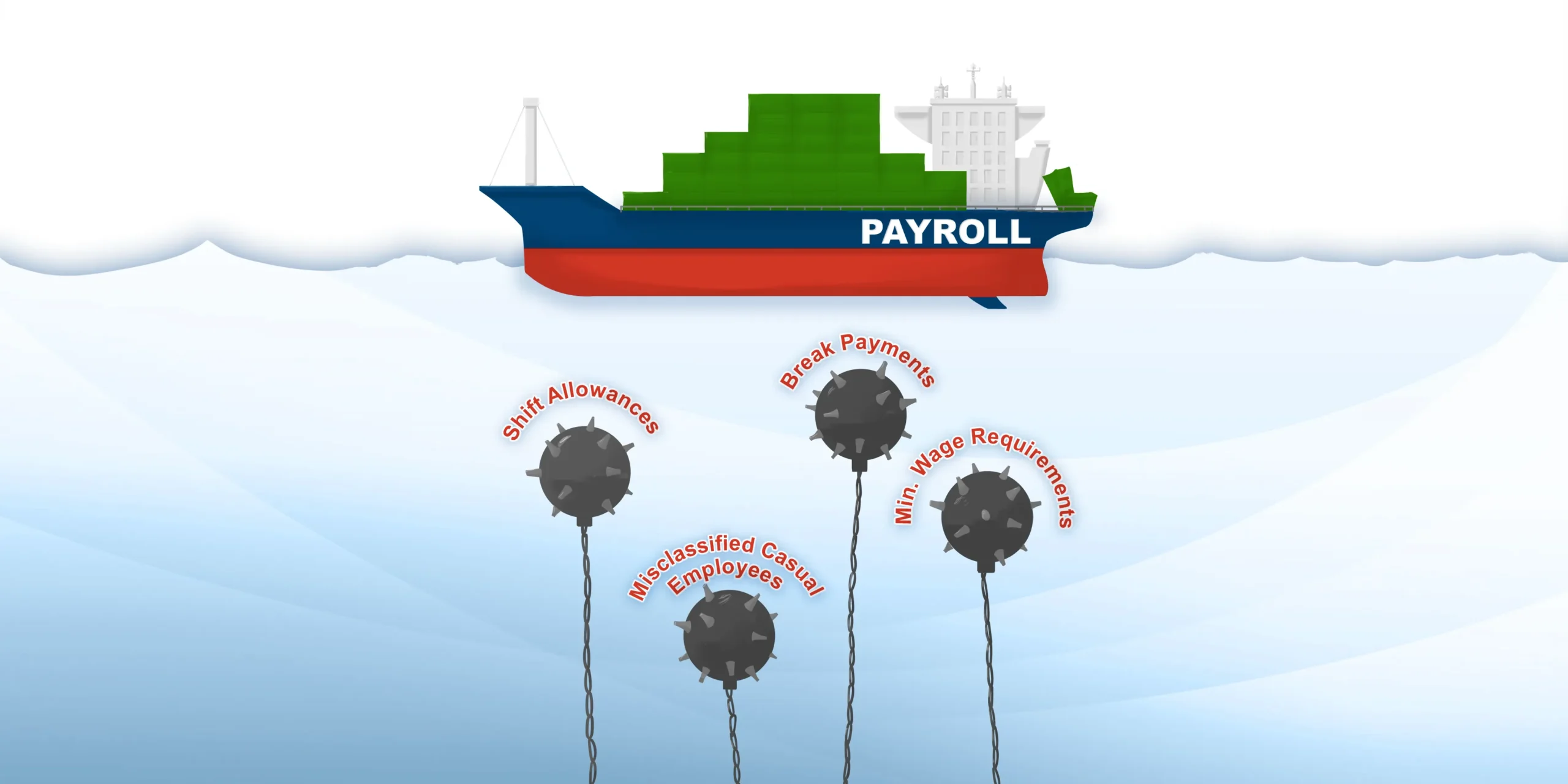

Have You Checked These Common Payroll Non-Compliance Issues?

Based on our experience helping over 50 organisations, here are some common payroll pitfalls we find outside of the Holidays Act:

- Incorrect Shift Allowances: We often find that employees rostered onto shifts outside their normal work pattern have not received the correct shift allowances they were entitled to.

- Incorrect Break Payments: Employees haven’t been properly paid for paid breaks. Identifying and rectifying these requires complex analysis, often demanding algorithms to accurately determine entitlement based on break taken, and verify actual compensation.

- Misclassified Casual Employees: Employees working a regular work pattern who are still treated as casuals. This means they should be accumulating leave rather than being paid 8% of their salary as PAYG. Not identifying this early on often results in organizations paying the 8% PAYG and then becoming liable for the leave they should have received as well – a costly double hit.

- Not Meeting Minimum Wage Requirements: Almost all employees must be paid at least the minimum wage amount, however the method to calculate minimum wage differs depending on how you are paid. Employees working additional hours can inadvertently end up being paid less than the minimum wage.

How Mero Can Help

We thoroughly understand the complexity of payroll data. Mero has extensive experience in HR and Payroll remediation across various industries and business sizes. Our unique approach allows us to efficiently identify, analyse, and remediate any non-compliant areas your business might have.

Rapid Start: We’ve worked with most New Zealand payroll providers, building a suite of pre-built extraction and import templates. This means we can get started fast.

Tailored Solutions: We don’t use a one-size-fits-all approach. We partner with you and your payroll provider to design a cost-effective solution tailored to your specific issue.

Auditable and Transparent: You’ll receive a detailed, fully auditable trail of all remediation transactions, giving you complete reassurance.

By partnering with Mero, you remove the guesswork and gain a safe, proven path to resolving your payroll compliance issues. Focus on running your business, knowing your payroll is accurate and secure.

Is your payroll compliant? Let’s find out together. Contact us for a confidential conversation about your specific payroll remediation needs.